Cloud adoption continues to soar, offering unparalleled scalability and agility. But this rapid shift has left many organizations struggling with runaway costs and outdated financial management frameworks. Traditional IT finance tools weren’t built for the dynamic, decentralized nature of cloud environments, where overprovisioning and underutilization can erode budgets.

Cloud financial management (CFM) bridges this gap. It’s not just about tracking costs—it’s about integrating financial accountability, strategic alignment, and intelligent automation into your cloud operations. By aligning cloud usage with business objectives, CFM empowers organizations to control costs, foster collaboration, and unlock new opportunities for innovation.

In this guide, we’ll explore best practices for CFM, its critical role in modern cloud strategies, and how advancements like Augmented FinOps are transforming cloud investment into a strategic advantage.

What is Cloud Financial Management?

Cloud financial management (CFM) is the practice of embedding financial accountability and governance into cloud operations. It builds on cloud cost management (operational insights and control) and cloud cost optimization (efficiency improvements) to provide a holistic framework for aligning cloud usage with strategic objectives.

Here’s how these components intersect:

- Cloud cost management: The foundation for visibility and operational control over cloud spending.

- Cloud cost optimization: A tactical approach to waste elimination through actionable insights and automation.

- Cloud financial management: Adds a strategic layer that ensures operational and financial efforts align with broader business goals like growth, profitability, and scalability.

For example, while cloud cost optimization may identify unused resources to terminate, cloud financial management ensures that these decisions align with long-term financial strategies and business outcomes.

What Cloud Financial Management Matters

Cloud financial management transforms cloud operations from a reactive cost center into a proactive strategic enabler. By embedding financial accountability into cloud strategies, organizations can optimize their investments and align them with long-term business objectives. Here’s why this approach is indispensable for modern enterprises:

Strategic Alignment of Cloud Investments

Without a clear connection between cloud spending and business outcomes, organizations risk wasting resources on low-priority initiatives. Cloud financial management bridges this gap by providing the tools and frameworks needed to tie cloud usage directly to strategic goals. This alignment ensures every dollar spent on cloud resources contributes to innovation, revenue generation, or operational efficiency.

Cross-Functional Collaboration

Effective cloud financial management unites IT, finance, and operations teams under a shared framework. By fostering transparency and open communication, it enables these groups to work together to prioritize initiatives, monitor costs, and achieve financial objectives. Collaboration isn’t just about avoiding silos—it’s about creating a shared understanding of how cloud resources impact the business.

Governance and Policy Enforcement

In cloud environments where resources can be spun up instantly, governance acts as the guardrail that keeps costs in check. Policies, automated tagging, and role-based permissions ensure consistency across teams and prevent untracked or unauthorized spending. Strong governance isn’t a constraint; it’s the foundation for enabling innovation within a well-defined structure.

Improved budgeting and forecasting

Accurate budgeting and forecasting depend on a detailed understanding of cloud usage patterns. Cloud financial management provides insights that allow organizations to anticipate spending spikes, allocate resources strategically, and avoid unexpected overages. By moving from reactive adjustments to proactive planning, businesses gain stability and confidence in their financial outlook.

Balancing innovation with cost control

At its core, cloud financial management is about embedding financial accountability into every layer of the organization. By creating visibility and fostering ownership at the team level, it cultivates a mindset where every department is invested in managing resources efficiently. This cultural shift not only reduces waste but also aligns everyone on achieving broader financial and operational goals.

Best Practices for Cloud Financial Management

To create a sustainable framework for cloud financial management, organizations must adopt strategic planning, collaborative governance, and a strong cultural foundation. These best practices can help you foster alignment and accountability.

1. Establish cost accountability

The cloud empowers engineering teams with unmatched flexibility to provision infrastructure at will. While this agility fosters innovation and experimentation, it can lead to decentralized decision-making, unchecked spending, and resource inefficiencies. IT leaders often face the challenge of managing sprawling cloud environments with costs that are difficult to monitor and attribute.

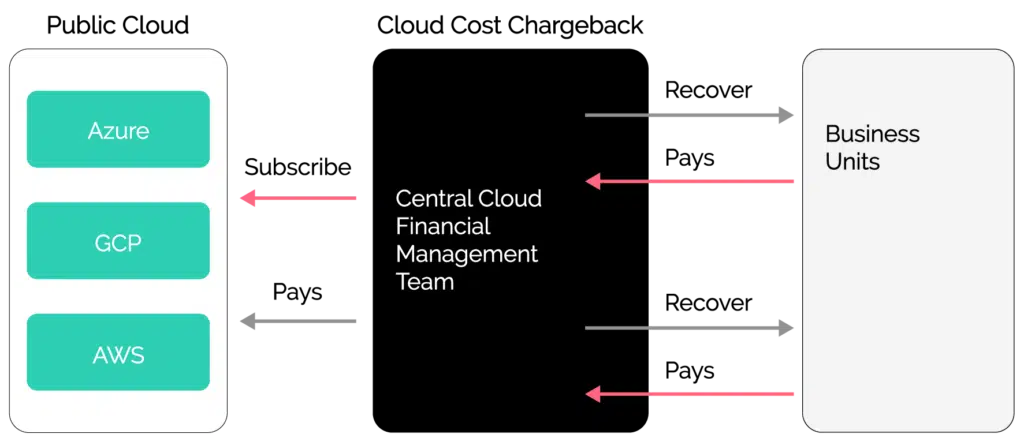

The foundation of effective cloud financial management lies in creating a culture of cost accountability. Cost allocation through tagging is crucial for achieving this, as it allows organizations to attribute expenses to specific resources, workloads, teams, and business units. This transparency enables the implementation of chargeback and showback models, where teams are either billed or made aware of their resource consumption.

Common cost allocation tags include:

- Environment: Production, development, testing, etc.

- Application: Identifying the workload or application.

- Owner: Assigning responsibility to individuals or teams.

- Cost center: Associating expenses with specific departments or budgets.

- Automation: Flagging workloads for automation opt-in or opt-out.

Beyond tagging, a consistent cost allocation strategy requires timely reporting and tailored insights for different stakeholders. This ensures teams have visibility into their spending and can proactively address anomalies.

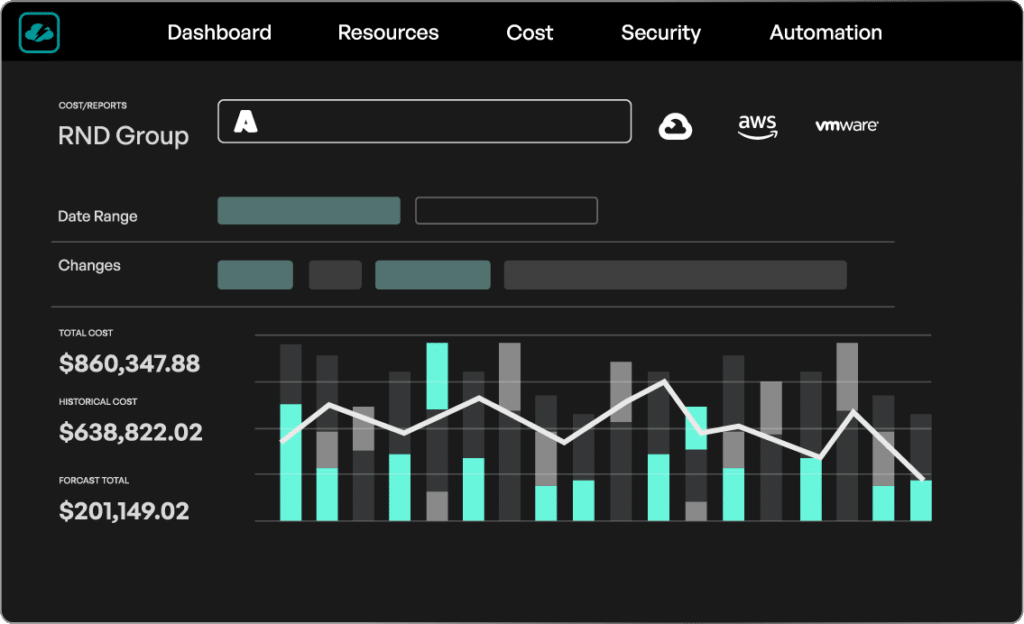

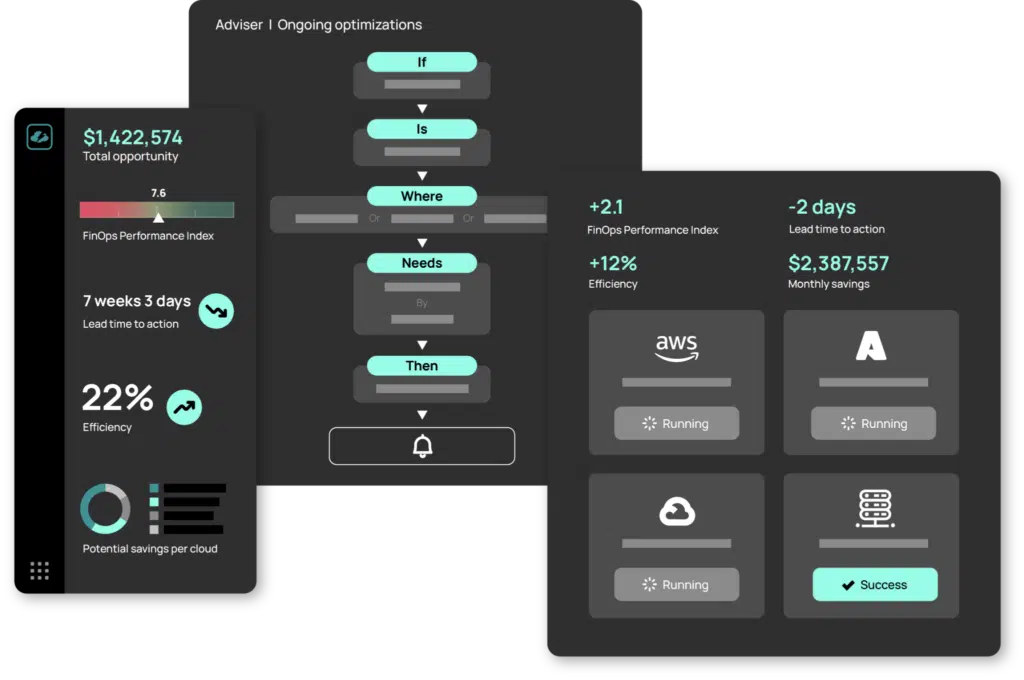

CloudBolt simplifies this process by offering a unified platform to manage cloud and non-cloud spending categories like private cloud and SaaS services. CloudBolt’s Augmented FinOps platform leverages the power of conversational AI to deliver real-time financial analyses that are tailor-made for different stakeholder groups.

Here are some examples of prompts that can be used for cost analysis:

- “Break down my AWS costs by departments and teams.”

- “Which services are responsible for the increase in my Azure bill?”

2. Forecast budgets accurately

Cloud forecasting and budgeting are essential components of cloud financial management (CFM) that enable organizations to plan and predict infrastructure costs effectively.

Accurate budgeting and forecasting involve analyzing historical usage trends and evaluating future infrastructure needs based on the application lifecycle. This process helps cloud financial teams intelligently allocate budgets across business units. However, the inherent dynamism of the cloud makes this process complex.

These are some of the common challenges faced by traditional FinOps teams when forecasting cloud budgets:

- Difficulty estimating costs for new workloads.

- Unpredictable resource provisioning by engineering teams.

- Mismatched forecasts due to unexpected pricing changes or usage spikes.

- Misaligned commitments with actual usage trends.

To mitigate these issues, organizations should adopt a granular and iterative approach to budgeting. This involves setting forecast levels (e.g., by team, service, or application) and establishing review cadences (e.g., weekly or monthly). Implementing proactive alert systems for anomalies or overspending ensures that financial targets remain on track.

Augmented FinOps tools like CloudBolt reduce the manual guesswork required to predict future cloud spend by leveraging advanced AI/ML algorithms to identify financial trends in the data. This is supported by customizable service patterns, including inherent guardrails to embed best practices into new workload provisioning. The tool also offers built-in control models and a paved road paradigm to budget cloud costs with superior accuracy.

By incorporating these capabilities, organizations can not only forecast budgets with precision but also integrate financial governance into cloud operations seamlessly.

3. Optimize resources at scale

Engineering teams often prioritize innovation and speed, which can push cost considerations to the sidelines. This can lead to missed optimization opportunities or challenges in acting on recommendations due to limited bandwidth or concerns about performance trade-offs.

To realize maximum business value from cloud investments, organizations should implement a comprehensive resource optimization strategy that addresses multiple dimensions:

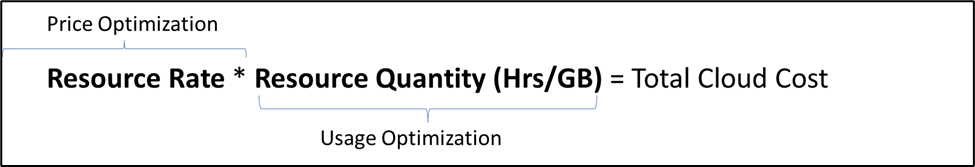

- Usage optimization: This involves identifying and eliminating waste, reducing idle resources, and aligning configurations with workload requirements. Common practices include terminating unused virtual machines, rightsizing EC2 instances, and selecting the optimal storage tier for each use case. These efforts ensure businesses only pay for resources that directly contribute to meaningful outcomes, freeing funds for innovation.

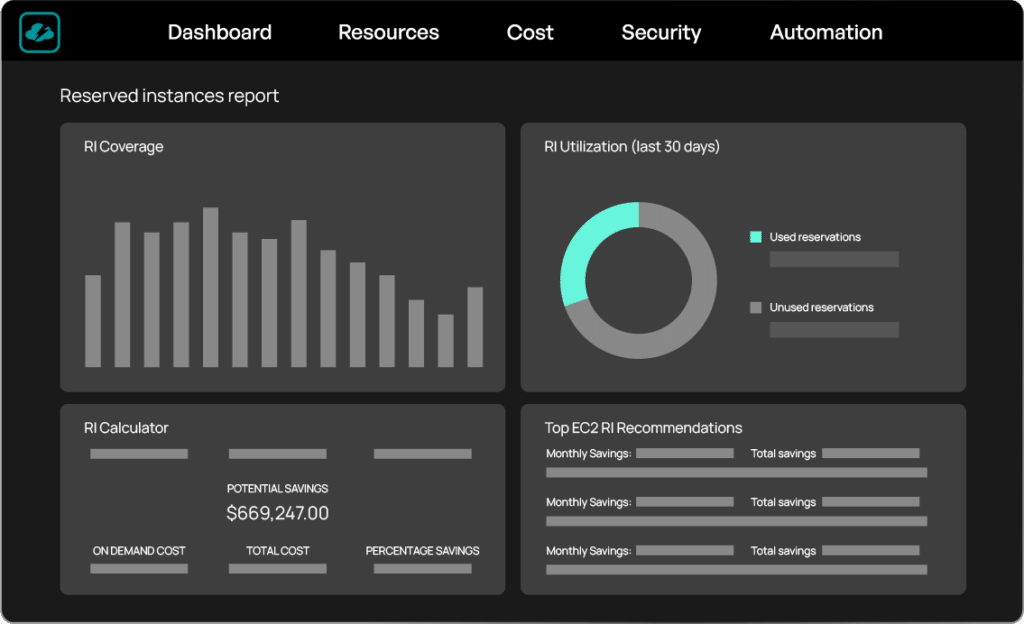

- Pricing optimization: Pricing strategies focus on securing cost efficiencies through effective use of provider offerings. Tactics include negotiating enterprise discounts, purchasing savings plans, and managing Reserved Instances (RIs) to align with projected usage. Successful pricing optimization requires a deep understanding of historical trends, future needs, and the intricacies of cloud provider pricing models.

Products like CloudBolt use advanced ML algorithms and the power of conversational AI to provide customized performance-based and cost-based recommendations. The cost automation executes optimization activities at scale, which frees up cloud financial management and the engineering team’s bandwidth to focus on other high-value tasks. The tools also help you understand when you should purchase new reservations and when to let the existing reservations expire. Automated nudges and warnings provide engineering teams with timely alerts on reservation utilization while avoiding waste.

4. Realize and track value

The cloud offers organizations unparalleled opportunities to accelerate development and innovation. However, this drive for technological advancement can sometimes result in suboptimal cost allocation, where investments may not align with the most impactful business outcomes.

To unlock the full value of the cloud, organizations must tie their cloud investments to measurable business value. By measuring unit costs, businesses can get a holistic picture of their profitability and make data-driven investment decisions.

Start with Actionable Metrics

Organizations should begin by focusing on easily definable metrics with readily available data.

Foundational metrics might include:

- Cost allocation percentage: The percentage of costs assigned to specific cost centers.

- Average resource utilization percentage: A measure of how efficiently resources are being used.

- Commitment coverage percentage: the percentage of costs covered by long-term commitment discounts

As cloud financial management practices mature, organizations can transition to more sophisticated metrics that quantify business value more directly.

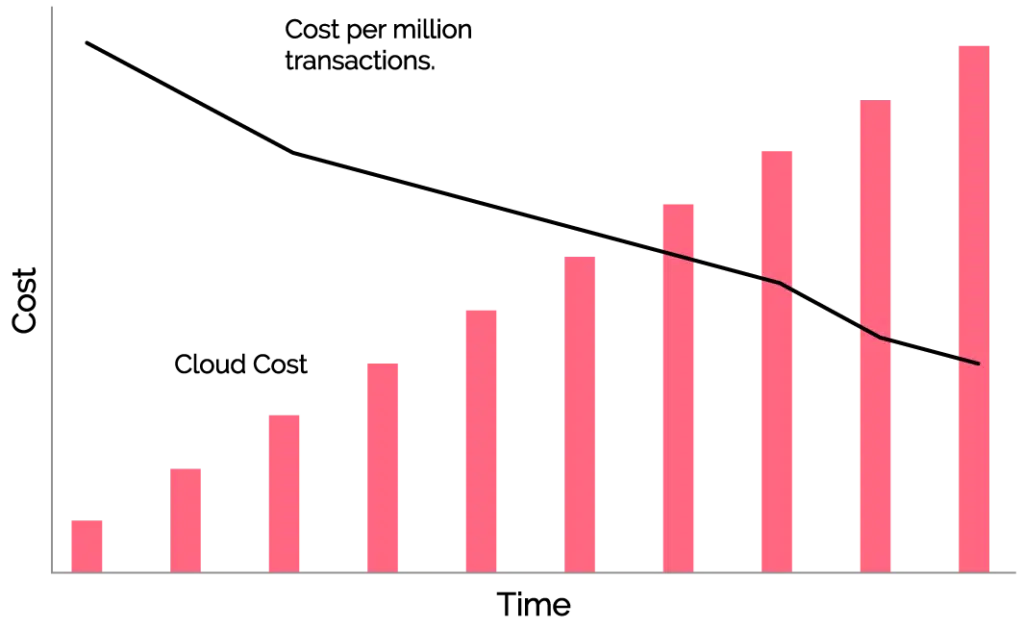

Example: Tracking Cloud Investment Impact

Consider a customer-facing workload for which a team tracks the cost per million transactions.

To calculate this metric:

- Aggregate the total cost of executing one million transactions, including cloud, SaaS, and license fees.

- Monitor this value over time to evaluate how cloud investments impact a key business outcome.

This approach not only highlights inefficiencies but also provides actionable insights for optimizing cloud expenditure to drive revenue or improve operational performance.

Advanced tools integrate financial data with business performance metrics, offering organizations the ability to refine their investment strategies. For example, you can use the unit economics metrics of cost per CPU core hour and cost per GB of RAM to decide on reservation usage and commitment volumes. This benchmarking process results in investment decisions that are continuously evaluated over time. Continuous review and refinement of metrics, along with a culture that rewards and celebrates small wins, are foundational keys to a successful unit metrics strategy.

5. Accelerate adoption with tools

As organizations navigate increasingly complex hybrid and multi-cloud environments, they often rely on a mix of on-premises infrastructure and multiple cloud service providers. While native tools from cloud providers like AWS, Azure, and GCP offer basic functionalities, they often fall short when addressing the advanced needs of modern cloud financial management teams—especailly as businesses scale and expand across multiple vendors.

Specialized multi-cloud finance solutions can accelerate the cloud financial management journey by providing a robust foundation for organizations looking to enhance their cloud financial management capabilities. These tools support a broad range of use cases, combining self-service, automation, and financial oversight to accelerate the journey toward optimized and accountable cloud operations.

Key Advantages of External Tools in Cloud Financial Management

External tools like CloudBolt help organizations streamline cloud financial management journeys across several critical areas:

AI-Assisted Analysis:

- Harness AI to analyze vast datasets and uncover hidden financial trends, variances, and patterns essential for informed decision-making.

- Identify and address spending anomalies by leveraging predictive models to forecast future cost deviations or inefficiencies.

Full-Lifecycle FinOps:

- Enable autonomous remediation to rapidly address inefficiencies by transitioning from cost insights to corrective actions with minimal manual effort.

- Integrate feedback loops to embed FinOps learnings into cross-functional practices, reducing the risk of overspending, noncompliance, or financial errors in future cycles.

Unified cloud fabric:

- Consolidate all cloud and non-cloud expenditures into a unified control framework, extending financial oversight beyond public cloud environments.

- Provide holistic visibility into financial performance across on-premises, private cloud, and SaaS resources, empowering more strategic decision-making.

Addressing Common Challenges in Cloud Financial Management

While cloud financial management provides a framework for accountability and efficiency, organizations often face challenges in its implementation. Here’s how to navigate the most common hurdles:

Balancing Financial Goals with Operational Agility

Organizations often struggle to balance cost control with the flexibility required for innovation. Strict financial policies may stifle creativity, while unchecked spending undermines financial objectives.

Dynamic cost-allocation models and real-time financial tracking offer practical solutions to this challenge. For example, organizations can implement pre-approved budgets for experimental projects, allowing teams to innovate within defined parameters while maintaining overall cost control. A tech startup, for instance, might use real-time dashboards to allocate budgets dynamically during product launches, ensuring resources are available for high-priority tasks without overshooting financial goals.

Resistance to Shared Ownership of Cloud Costs

Teams may resist accountability for cloud costs, especially when financial goals conflict with operational priorities. This resistance can hinder the adoption of cloud financial management practices.

Overcoming this challenge requires leadership to communicate the strategic importance of cost accountability and tie financial goals to team performance metrics. For example, a SaaS company might create cross-functional FinOps teams comprising finance, IT, and operations stakeholders. These teams foster collaboration, promote transparency, and ensure that financial management practices align with organizational goals. Training programs and clear communication about the benefits of shared ownership further help embed financial accountability into the organization’s culture.

Complexity in Enforcing Governance Policies

Ensuring consistent enforcement of governance policies across diverse cloud environments can be challenging. Inconsistent tagging practices, lack of visibility, and decentralized resource management often lead to inefficiencies.

Automation plays a crucial role in addressing this complexity. Tools that enforce tagging standards, monitor policy compliance, and provide real-time visibility into cloud usage simplify governance and ensure consistency across the organization. For instance, a retail company might use automated tagging systems to ensure all resources include metadata for cost allocation, owner identification, and project categorization. This approach reduces administrative overhead, improves reporting accuracy, and ensures governance policies are consistently applied across multi-cloud environments.

Final Thoughts on Cloud Financial Management

Cloud financial management is an evolving journey that demands collaboration across engineering, finance, and procurement teams. While traditional FinOps provides a solid starting point, the complexities of modern cloud environments require a more proactive approach to align financial accountability with operational agility.

Augmented FinOps represents this next phase, combining financial governance with advanced technologies like AI, machine learning, and intelligent automation. By adopting these innovations, organizations can ensure that cloud investments deliver measurable value while maintaining cost efficiency.

Tools like CloudBolt are uniquely positioned to support this transformation. With capabilities that integrate financial insights, automation, and cross-functional collaboration, CloudBolt empowers organizations to take control of their cloud spend and focus on strategic growth.

Ready to take your cloud financial management to the next level? Schedule a demo today to see how CloudBolt can help you integrate smarter financial strategies, simplify complex operations, and unlock the full potential of your cloud investments.

Transform Cloud Finances with CloudBolt

Schedule a Demo

FAQs on Cloud Financial Management

What are the emerging trends in cloud financial management?

Emerging trends in cloud financial management include incorporating sustainability metrics, such as carbon footprint tracking, alongside financial data to optimize both costs and environmental impact. AI and machine learning are increasingly used to deliver real-time insights, predict cost overruns, and recommend corrective actions. The rise of multi-cloud strategies has driven demand for unified dashboards that consolidate and analyze costs across providers. Furthermore, advanced FinOps practices emphasize integrating CFM into broader business strategies, enhancing collaboration and decision-making.

What role does CFM play in long-term cloud strategy?

CFM serves as the foundation for aligning cloud investments with long-term business goals, ensuring spending is both efficient and strategic. It enables organizations to engage in forward-looking budgeting, demand forecasting, and scenario planning, creating a sustainable framework for growth. By embedding governance and financial accountability into operations, CFM helps businesses avoid overprovisioning while ensuring resources are allocated to high-impact initiatives. Ultimately, CFM transforms the cloud from an operational cost center into a driver of innovation and scalability.

What’s the difference between automated and manual financial management in the cloud?

Manual financial management relies on spreadsheets and manual tracking, often resulting in errors, inefficiencies, and reactive decision-making. Automated CFM, on the other hand, uses AI-driven analytics to provide real-time visibility, predictive insights, and automated actions. This reduces the administrative burden on teams, allowing them to focus on strategic priorities. Additionally, automation ensures faster, more accurate reporting and optimization, helping organizations keep pace with the dynamic nature of cloud environments.

Are there quick wins for implementing cloud financial management?

Yes, quick wins in CFM include implementing tagging policies for better cost allocation and identifying idle resources for immediate savings. Setting up budget thresholds and alerts for anomalies allows organizations to act proactively rather than reactively. Focusing on a single project or team to implement chargeback or showback models can demonstrate value quickly and build organizational momentum. Over time, these initial steps pave the way for broader adoption of CFM practices and tools.

How can smaller organizations get started with CFM?

Smaller organizations can begin their CFM journey by utilizing free or low-cost tools provided by cloud service providers to track usage and spending. As they grow, they can adopt more advanced solutions that offer automation, governance, and real-time insights. Focusing on foundational practices like tagging, budget alerts, and basic cost reporting can provide immediate benefits. By starting small and scaling strategically, smaller organizations can build a robust CFM framework that supports their growth and innovation goals.

Related Blogs

The End of Manual Optimization: Why We Acquired StormForge

Today is a big day for CloudBolt—we’ve officially announced our acquisition of StormForge. This marks a major milestone for us…